Generate Yields on Your Crypto Holdings

by Dan Cecilia

A simple guide to choosing the right savings wallet

If you are a long term Bitcoin hod-ler, then you rarely pay attention to short term moves in the bitcoin market. You simply want to hold bitcoin as a store of value against the decay of traditional fiat. Regardless of your method of storage, you should be aware of the various savings products that are popping up as a result of the DeFI movement.

TL;DR you can just reference the most popular yield generating DeFI products on Loan Scan. As always, DYR.

NEXO

The product I personally use is Nexo which at the time of writing boasts an 8% APY savings rate.

Nexo has been around since 2018 and provides instant crypto-backed loans. It allows digital asset owners the ability to access fiat liquidity without the need to sell their crypto holdings. The loan is secured by the market value of the digital assets in the account and the user avoids tax liabilities, platform fees, market slippage, not to mention the carrying costs to access a margin loan or complexities associated with utilizing swaps.

Nexo provides access to 40+ fiat savings accounts and is available to clients in over 200+ jurisdictions. Its products are secured by BitGo and guarantees custody insurance of up to $100,000,000 through Lloyds of London. AML/KYC is performed by jumio. Check out Nexo security and compliance page.

In short, Nexo users can access liquidity instantly anywhere around the globe to transact in fiat while maintaining the upside exposure to the digital asset in their wallet. You do not lose ownership of your crypto and you are not subject to credit checks because the crypto in your account is used as collateral.

How it Works

The Nexo whitepaper explains how it works in 4 simple steps:

- Client transfers Crypto Assets to the Nexo Account

- Client Receives instant loan in USD, GBP or EURO

- Client Repays Loan

- Withdraw Crypto from Nexo Account

The savings and borrow terms as well as the account maintenance and repayment analytics are managed by the Nexo Blockchain Oracle. The oracle takes care of the administrative tasks that a traditional financial institution would engage in. The oracle smart contract provides instant loan approval, processes repayments, and pays interest to depositors. The Nexo blockchain oracle is an automated independent system that maintains Nexo’s key operating functions.

The NEXO Oracle

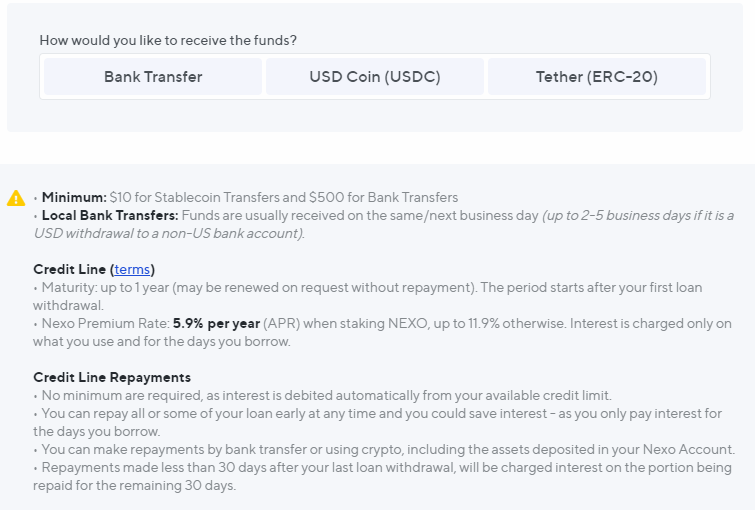

Source: Nexo Business OverviewThe simple reason that Nexo is able to provide such a high APY to savers is that it charges a high short term rate to borrowers. If you open an account and take out a loan you can clearly see the interest charged in the fine print on the instant loan screen. This is similar to any type of traditional banking model which makes money off the “spread” between what it charges borrowers and what it pays to depositors.

Loan Term

Example Loan Term

Source: Nexo PlatformRisks

There are certainly risks to opening up an account with Nexo and as always it is best to only deposit an amount that you are comfortable with not needing immediately. The biggest risks that users of Nexo expose themselves to is the uncertainty around jurisdiction for the product and oracle risk. Also, it is safe to assume that any user who generates passive income on their holdings in Nexo would not be without taxable income liabilities. It is still unclear how this is treated and there are no form-1099s generated.

It should be made clear that you use the products at your own risk and Nexo makes it clear that it is not liable for any of the risks associated with the usage of digital assets and you as the account holder should carefully consider if the product is right for you.

Additional Information

For more information on Nexo products check out the below links

Whitepaper

Business Overview

Security

Earn Terms

Borrow Terms

Blog

Token

Legal

Investor relations: [email protected]

General Inquiries: [email protected]