What are Stablecoins?

Anyone familiar with cryptocurrency knows just how volatile they can be. Extreme swings are a regular occurrence, and while volatility is not necessarily bad, it can cause issues for both merchants and investors. As a result, we have seen a push to create reliable, stable cryptocurrencies that hold their value. These cryptocurrencies are known as stablecoins.

What is Volatility?

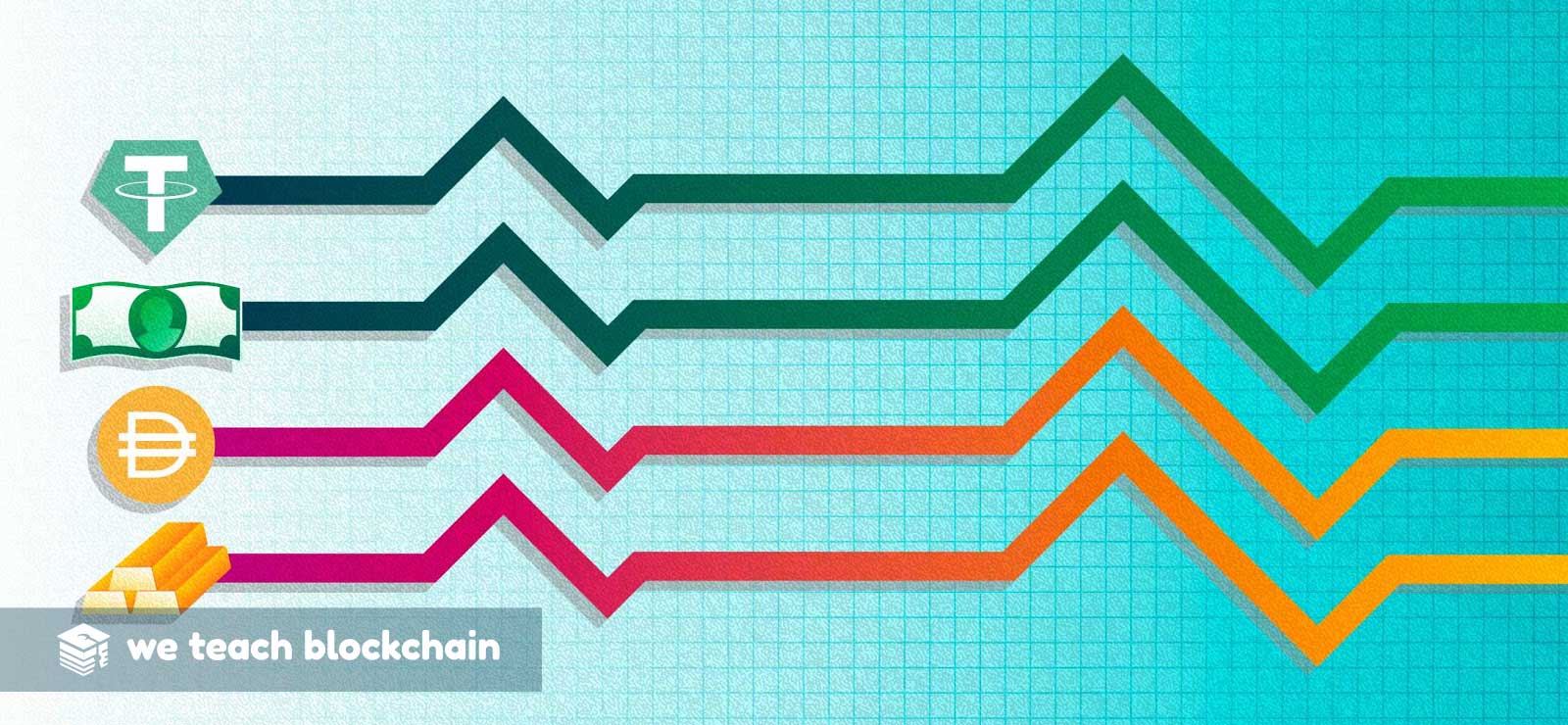

Volatility is the range of price that an asset could potentially reach, whether positive or negative. In other words, it is the variation of price over a duration of time.Stablecoins are cryptocurrencies that are pegged to a specific value and backed by fiat, assets, or other cryptocurrencies. In an ecosystem full of volatility the goal is for the price of a stablecoin to stay at the pegged value (usually one USD) or as close to it as possible.

Why We Need Stablecoins

Merchants

For cryptocurrency to gain widespread adoption in a business setting, merchants and corporations need some guarantee that there will likely be some stability in the value of that cryptocurrency. Simply put, merchants aren’t going to accept a currency that is not likely to hold its value.

Markets

Cryptocurrency is usually purchased at an online exchange, but there are not many fiat-to-cryptocurrency markets. Instead, stablecoins are used as an intermediary tool for market pairing. Fiat can be converted to a popular stablecoin that has many different market pairings. Tether was one of the earliest stablecoins to gain popularity. As a result, most exchanges offered markets with BTC (Bitcoin), ETH (ethereum), and USDT (Tether) pairs.

Remittance

Sending money across borders is traditionally expensive and slow. You might have to wait a week for a cross-border money transfer to be finalized. Cryptocurrency has proven to be an efficient and relatively inexpensive way of transferring money around the world. Stablecoins offer the ability to transfer value quickly without having to worry about the possibility of a rapid decline in price.

How Stablecoins Stay Stable

Stablecoins are all designed to hold a consistent price, however, different stablecoins have found different ways of achieving this goal.

Fiat Backed

The simplest of stablecoins. The token is pegged to a fiat currency. For example 1 GUSD (Gemini Dollar) = 1 USD. The tokens value is represented as a digital dollar. Most stablecoins follow this pattern.

Fiat backs tokens on a 1:1 ratio. For every unit of currency held there is one token issued. When the token is exchanged for fiat, they are taken out of circulation. When someone wants to buy the stablecoin, their fiat is sent to the reserve and new coins are created and issued. Simply put, these stablecoins are backed by relatively stable fiat currencies. The vast majority of stablecoins either represent the USD or Euro as they are the most popular global currencies.

Stablecoins Backed By Dollars

Tether

Tether (USDT) is a cryptocurrency that is designed to mirror the value of one USD. 1USDT=1USD. Basically, Tether is used to turn fiat into a stable, digital token. The original idea was that the company behind Tether would maintain a cash reserve equal to the number of tokens. If Tether is redeemed, those tokens are burned. Tokens are created by contributing to the Tether reserve.

Over the past two years, there has been some controversy surrounding Tether, specifically their cash reserves. The root criticism is based on the fact that Tether is highly centralized. This also means that their reserves didn’t have the transparency needed to instill trust in its users. This led some to question whether Tether had the funds to back their supply. Many called for Tether to be audited. There was also concern about what would happen to the entire cryptocurrency market if it was found that Tether did not have the funds that they claimed they did.

Before any type of audit could occur, the Hong Kong-based company behind Tether changed the wording on their website ever so slightly. Instead of claiming that Tether was backed 1:1 by dollars, they now claimed that their cash reserves and other assets were used to back the value of the token. This change may have scared some users away, but those using USDT as a short-term medium of exchange have not been deterred. We have, however, seen more stablecoins gain popularity as questions around Tether’s backing assets remain.

Gemini Dollar

Another popular stablecoin is known as the Gemini Dollar (GUSD). This token was introduced by the team behind the Gemini Exchange, which was started by early Bitcoin enthusiasts, the Winkelvoss twins. Gemini Dollar is an ethereum-based token that uses the ethereum platform to function. GUSD is the first regulated stablecoin, as recognized by the New York State Department of Financial Services. This transparency is in extreme contrast to Tether. The funds that back Gemini Dollars issued and in circulation are held at State Street Bank and Trust Company.

Additionally, the USD balance of the relevant bank accounts is examined by a registered public accounting firm. Their reports are made public. However, this isn’t the only audit that GUSD has undergone. The code within the GUSD smart contract is public and has been publicly audited. The approval of this regulatory body and the stringent practices employed by Gemini gives users confidence that their funds are sufficiently backed.

Asset Backed

Some cryptocurrencies are backed by the value of physical assets like gold.

Digix Gold

Each Digix Gold Token is supposed to be backed by a gram of gold in a vault in Singapore. Gold is a notoriously stable asset. This has allowed the Digix Gold Token to fluctuate only 25% since 2016.

Crypto Backed

Stablecoins can also be backed by other cryptocurrencies. While this seems like an impossible prospect considering the volatility of cryptocurrency, projects have created ecosystems that have been able to maintain a relatively stable value. To ensure some stability this type of stablecoin is usually backed by the more stable cryptocurrencies, mainly bitcoin and ether. To further ensure the price stability of cryptocurrency backed stablecoins they can be backed by more than one cryptocurrency. If you spread your backing assets among several cryptocurrencies, there is less chance of experiencing overall volatility compared to relying on one cryptocurrency to hold its value. However, cryptocurrency backed stablecoins are more likely to see fluctuation in price when compared to stablecoins backed by dollars.

The solution is a practice called over-collateralization. Instead of a fiat backed stablecoin that is backed by a 1:1 token to cash reserve, crypto-backed stablecoins are often backed by a 1:>1 token to cryptocurrency reserve. Simply put, since cryptocurrency is more likely to fluctuate than fiat currency, the reserves have to amount to more than the value of tokens in circulation. With this method, price drops of the backing assets can occur without the stablecoin losing value. Since the backing asset is a cryptocurrency, not only is there transparency within the stablecoin contract, there is also a transparent blockchain that is recording the history of the backing cryptocurrencies. Transparency can be achieved without the help of a third party.

DAI

MakerDAO is an ethereum-based project that uses two volatile cryptocurrencies (ether and the Maker token) to stabilize the price of a third cryptocurrency, DAI. Despite this somewhat complex ecosystem, DAI is supposed to remain around 1 USD. DAI has been battle-tested; the price of ether saw drastic drops in 2018, however, DAI maintained 93% of its value and quickly returned to 1 USD.

A key mechanism that allows DAI to maintain enough collateral to back its tokens is what is known as a Collateralized Debt Position (CDP). The amount of ether that has to be staked to create a DAI token is variable. Usually, it takes about 1.5 ether to create a dollar amount of DAI. For example, $150 worth of ether can be leveraged to create 100 DAI. If the price begins to fall, the amount of ether required to create DAI may be decreased in the hopes that more money will be injected into the Maker ecosystem. The Maker token is used to pay for fees on the network. It is not mineable and the token supply is managed in order to stabilize the price of DAI. This process is facilitated through a smart contract that creates collateralized debt positions.

The amount of DAI created by the smart contract corresponds to the amount of ether sent. This ratio is fixed by the Maker network but can be amended to stabilize the price of DAI if there is a significant fluctuation in ether’s price.