Getting into cryptocurrency may seem intimidating, but if you have the proper tools and knowledge, the process isn’t so difficult. Follow this guide before you make your first cryptocurrency purchase.

CRYPTOCURRENCY WALLETS

A wallet is the cryptocurrency equivalent of a bank account that allows you to send and receive cryptocurrency. Wallets don’t actually store your cryptocurrency. Instead, the funds are stored on a blockchain and the wallet acts as an interface that allows you control of your funds. A wallet is just a graphical interface that easily allows you to manage your address and store your keys. Not all cryptocurrencies can be stored in one wallet. Some wallets are currency-specific, but most support multiple currencies. As long as you have control of your private keys, you have full control of your cryptocurrency. It is risky to keep your cryptocurrency on an exchange because you do not have sole control of your private keys. There have been several hacked exchanges that have lost significant amounts of money.

Paper Wallets

Keeping cryptocurrency “offline” is known as cold storage. The cryptocurrency is not stored on a web-based app or computer; it is just suspended until you are ready to restore a wallet using your seed phrase or private keys.

Hardware Wallets

One of the most secure ways to store your cryptocurrency is a hardware wallet. These are physical devices, usually the size of a thumb drive, that act as a vault for your digital money. While keeping your money in a vault is the safest method, it can make performing transactions difficult. Popular hardware wallets include, but are not limited to, the Nano Ledger S, Trezor, and Digital Bitbox.

Mobile Wallets

There is an option for you if you’re looking for a wallet for everyday spending. Mobile wallets allow you to store your cryptocurrency right on your phone. Need to pay for something? Just whip out your phone, open your wallet, enter an amount, and scan a QR code. It’s a four-step process that takes about a minute, of course depending on which blockchain you are using. ERC-20 tokens, among others, are more conducive to acting as simple transactional currencies since they have shorter confirmation times, meaning you have to wait less time for your transaction to be processed and completed. However, many blockchains are working on additional layers that could help with smaller, continuous payments. Mobile wallets that are compatible with multiple cryptocurrencies include Jaxx, Coinomi, and Bread.

Desktop Wallets

Some projects allow you to download wallets directly from their website. They offer their software client but require you to be at your computer for use. A popular desktop wallet for Bitcoin is Electrum.

Web Wallets

Similar to desktop wallets, web wallets provide a website that allows you to interface with the blockchain. While many projects also provide web wallets, several popular websites offer multi-token web wallets such as MEW and MyCrypto

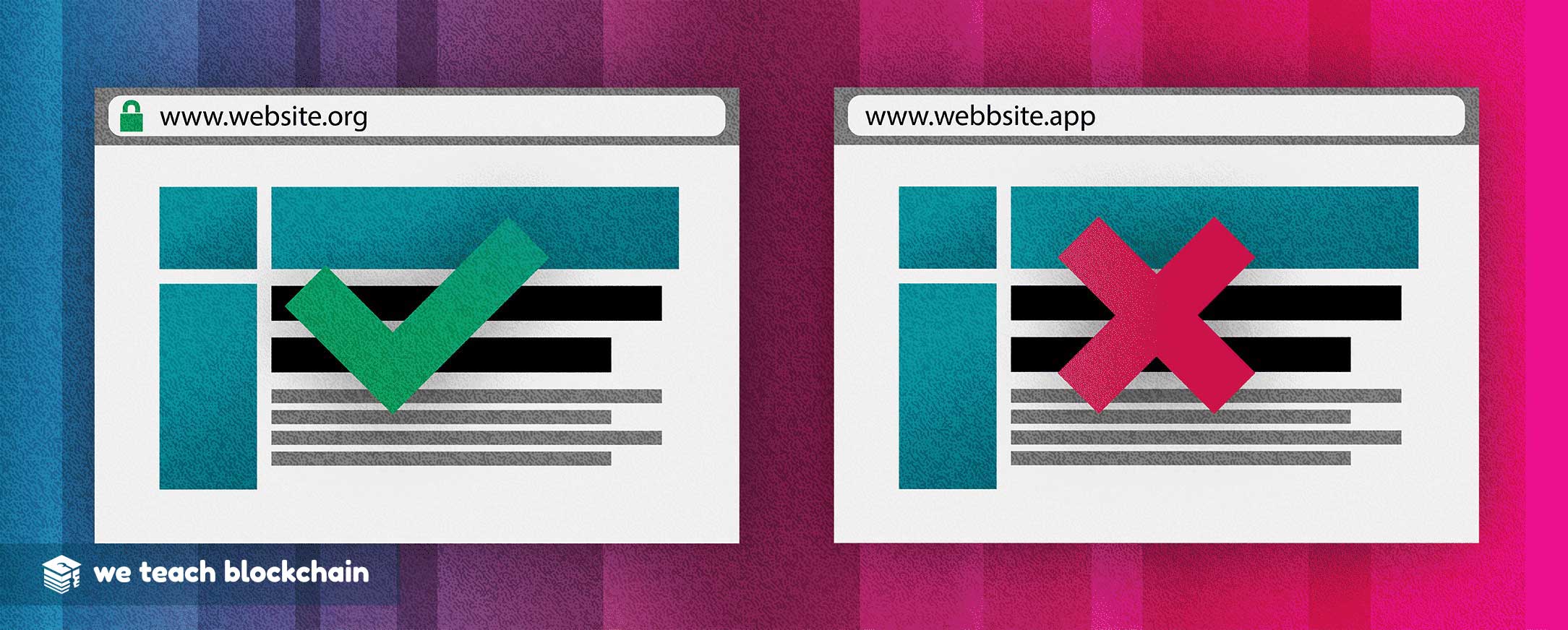

A major issue with web wallets is that they are especially susceptible to phishing. Phishing is an exploitative tactic where someone creates a look-alike website, and some of these sites are pretty much clones with very similar URL addresses. These fake sites have a login section that records your username and password. They then take this stolen information and use it to access your funds. There are a couple of ways to defend against phishing. The first is not to click on any unknown links and ALWAYS check the web address you type into the URL bar. If you plan on interacting with the Ethereum network, it’s recommended that you download the Metamask extension, using it together with a web wallet. Metamask automatically blocks these fake websites. Always double-check web addresses, but no one is perfect. Metamask provides an extra layer of security.

CRYPTOCURRENCY EXCHANGES

When it comes to buying cryptocurrency, there are two types of exchanges where they are purchased.

Centralized Exchanges

Centralized exchanges have a third party database acting as a middleman to help facilitate transactions. Although moving forward the community will likely focus on ironing out the issues with decentralized platforms, centralized exchanges have helped add liquidity to the crypto markets. Take Coinbase for example. Most people in the crypto space have interacted with Coinbase for their first crypto transaction because of its easy to use interface and popularity. Coinbase is also partnered with many products that make spending your cryptocurrency easy and have achieved recognition and accredidation.

Centralized exchanges are just one tool in your toolbox, and they are not your permanent wallet. Just like you wouldn’t use a hammer to fix every problem in your house, you won’t use centralized exchanges for every cryptocurrency buying or selling scenario. There is a risk in storing your crypto on exchanges, especially centralized ones where you do not own your keys. Think of them as ATMs at a currency exchange for your crypto. You don’t leave your debit card in the reader after the transaction, don’t do the same with your digital keys.

Decentralized Exchanges

A decentralized cryptocurrency exchange (DEX) cuts out the middleman by facilitating deals via smart contracts. The cryptocurrency is never in the possession of an escrow service. The platform merely connects the P2P participants. DEX platforms offer at least partial anonymity, but the trade-off is that these platforms are often harder to use. Fees are reduced significantly because there is no central authority looking to take their cut. Since DEXs are not managed by a central party, users usually do not need to disclose personal information like their photo ID or address to trade.

Because Decentralized Exchanges are harder to use, they do not have the same liquidity that you find in centralized platforms. Additionally, if you lose your password you can’t contact customer support; there is no third party to reverse any transactions.Because of KYC and AML regulations, legitimate decentralized exchanges do not support fiat conversions, as this would introduce a point of centralization.

METAMASK // Metamask.io

Another important thing to note is that the keys entered are not transmitted over the network, but rather stored in the browser cache. Make sure to protect yourself from phishing sites with extensions like Metamask, which will alert you if they feel you have gone to a potential phishing site.

Getting involved with cryptocurrency may seem intimidating, but following a few simple steps will get you ready for your first transaction. Just like money and other forms of payment, cryptocurrency is stored in a wallet. While a physical wallet is used to keep your physical forms of payment secure, a cryptocurrency wallet is a digital wallet used to store a digital currency or asset. Cold wallets sacrifice usability for security, while hot wallets are designed for everyday spending. Additionally, there are different types of wallets based off of a method of access.

Once you have a cryptocurrency wallet, you can make your first cryptocurrency purchase. There are a variety of ways to do this. The most popular places to buy cryptocurrencies are exchanges, which can be separated into two classifications. Centralized exchanges rely on a third-party facilitator to complete transactions, often taking a larger fee per transaction than Decentralized exchagnes. Decentralized exchanges essentially allow users to interact directly, with greatly reduced fees. However, decentralized exchanges offer no recourse if an issue arises. Additionally, some services allow you to meet with local cryptocurrency buyers and sellers.

Although it might be intimidating at first, studying and entering the cryptocurrency markets is easier than it seems. Additionally, increased banking adoption of cryptocurrency and blockchain technology has a great chance to change how interbank transfers are settled. This process offers a lot of hope for the future of blockchain in business. We’ll look at the potential impact that blockchains can have on businesses today and in the near future.